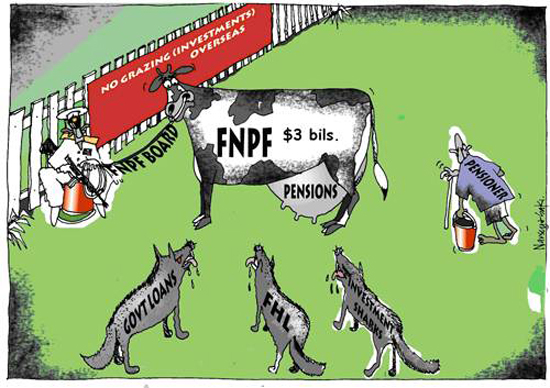

“The fund would be a compulsory savings scheme for wage and salary earners who would make periodic contributions through deductions from their wages, at one shilling per every pound earned, with matching contributions from employers. The fund would not only provide social security but also act as stimulus to growth through local savings.”

OPINION: If the giveaway denomination of shilling and pound was not there, one could be forgiven for having assumed the above quote was from a report to Prime Minister John Key, urging him to implement a compulsory KiwiSaver scheme for New Zealand.

No, the above was an extract from the J. E. Ashford Report to Fiji’s Legislative Council in 1961 when Fiji was far ahead of its developed neighbours in having introduced a compulsory Fiji National Provident Fund (FNPF) pension and saving scheme more than half a century ago.

While New Zealand did emulate such a scheme under a Labour government some 15 years later, it was subsequently scrapped by a very non-visionary leader.

No sooner had National Party’s Robert Muldoon come to power, than he scrapped a similar compulsory saving scheme in 1975.

It has been pointed out on many occasions that this was one of the worst political decisions made in New Zealand.

Had that pension been allowed to survive, it has been estimated that today such a saving scheme may have delivered a saving to the tune of some $240 billion.

If the National Party leadership had been more visionary and retained the compulsory saving scheme in 1975, its savings delivered today would not only have kept the international rating agencies from knocking on our doors, but may have also enabled us to borrow when in dire straits like natural disasters or finance company collapses. That may have also saved Bill English from presenting such a dreary budget over half a century later.

The art of saving

For a change, Kiwis should have learnt the art of saving from their neighbours who had recently emerged from a traditional, subsistence and village way of life.

An India-born barrister, the late A. D. Patel, leader of the National Federation Party, not only pushed for a regional university for Fiji but also a retirement saving scheme the fruits of which are reaped by the new generation who have migrated.

New Zealand and Australia have been great beneficiaries of Fiji’s FNPF scheme. If a survey was undertaken today of home ownership among migrants since Fiji’s first coup in 1987, migrants from Fiji may lead the field.

This is because after working for many years and with contributions ranging from 6c to 8c a dollar, matched by employer contributions, accumulated to healthy sums over the years.

They migrated with these savings and put that amount as deposit to buy houses in New Zealand. This had been boosted by over five percent annual dividends from funds invested by FNPF. The accumulated compounded funds over the years have been a source of finance for major capital developments in Fiji.

This commenced in 1961, when half a century later, a developed OECD member country like New Zealand is still struggling to have something in place which could remotely resemble an extremely successful experiment in a lesser developed Fiji.

This author benefitted from the FNPF saving scheme to purchase a house in Fiji and also financed my daughter’s education in New Zealand. Many others have used part of their savings in similar ways, and also used funds for medical treatment or for emergency funds during natural disasters.

Fiji example

If leaders in New Zealand had a vision like A. D. Patel and allowed the New Zealand version, initially introduced in 1975 to live, imagine the bundle or ready funds at the disposal of the government which is today borrowing some $300 million, reportedly from the Chinese government.The Finance Minister’s tampering with KiwiSaver does little to instil our confidence in such a scheme which has been a political football in the past.

What is more intriguing and lacking in good faith is what has been revealed by Adam Bennett, political reporter at the New Zealand Herald. The Greens co-leader Russell Norman labelled this as “a great tax switcheroo”.

This is because for those earning above $58,000, government will get back more in its newly introduced tax on employer contribution than it would give in annual incentives. At $60,000 salary, government will get $18.67 more in tax than its incentive contribution, while at $100,000 salary, the government will be sitting comfortably with additional taxation of $468.57 (a tax of $990 against the government incentive of $520).

Under the 2011 budget changes, government contribution has been halved from $1040 per year to $520 per year, resulting in a saving of some $2 billion dollars. It has also increased minimum employer and employee contribution to 3percent and imposed taxation on employer contribution which was tax free until now. This is expected to yield government $680 million over the four year period to 2015.

The bad faith of government is revealed in not only its tampering with this savings scheme which shatters public confidence in it, but despite promising that the changes would not affect people before the November election, the changes to KiwiSaver scheme would in fact be effected in six weeks time, from July, 2011.

While it appears that the government is cutting taxes, in actual fact we end up paying more in a roundabout way. I know some relatives and friends who were sceptical since the inception of KiwiSaver, knowing it was expendable and would come under the slashing knife when an opportunity arose. They were waiting to join the scheme, hoping it would not be tampered with.

Hitting the pocket

However, since they fall above the $58,000 salary mark, the government will take more from them in form of taxes than paying them as concession. Hence they will not join, and there goes the intention to promote this scheme.

Some existing members may decide to get out of the scheme as well, especially those on higher salaries, as the effect of tax on government incentive hits their pockets.

Commentators generally agree that the long-term vision of government should be savings and they should avoid tinkering with this scheme. The $1040 incentive meant a great deal for the middle to low income earners and the self-employed.

Others have echoed that there was no incentive to savings which needed to grow. These changes do little to encourage savings.

The lament is that had a developed neighbour like New Zealand followed the path of the then British colony Fiji which implemented compulsory saving scheme in 1961, we would have had a more aspirational budget that would have attempted to address the fundamental structural problems - rather than tinkering with such a saviour compulsory saving scheme which had already proved its benefits in smaller and poorer countries.

Perhaps Bill English and John Key from a First World need to bite the humble pie and learn from successes of other lesser developed nations, in this instance, Fiji. They need to stop re inventing the wheel.

Better still, the least they can do is stop poking sticks in the bicycle wheel that has encouraged so many join a savings scheme that had been going on well until the expedient budgetary intervention by the government.