Liam Dann

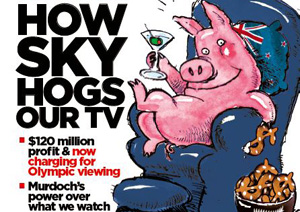

AUCKLAND (New Zealand Herald / Pacific Media Watch): Sky TV shares have gone into a trading halt today as the Rupert Murdoch media group News Corp sells its 43.6 percent stake into the market at a price of $4.80 - a 7 percent discount to its $5.17 close on Friday.

The price gives News Corp's 169.8 million shares a total value of $815 million.

At the close of trading on Friday the market capitalisation of Sky TV was listed at $2.01 billion.

The deal is understood to have been tendered by News Corp and investment banks Deutsche Bank and Craigs Investment Partners are underwriting the deal.

No cornerstone shareholder is expected to take a stake in excess of 19.9 per cent - a level that would require a full takeover offer to be made.

Another substantial shareholder - the Todd family - sold its 11.11 per cent stake in Sky TV in November last year to Credit Suisse, which on-sold it to institutions and private investors.

That block of shares was sold at $5.05 a share for about $218 million.

Dominant shareholder

News Corp has been the dominant shareholder in Sky TV since late 1999 when it took control through newspaper company INL.

Last month Sky TV reported a 9 percent gain in first-half profit as subscribers migrated to its MySky premium service and spent more.

Profit rose to $68.2 million in the six months ended December 31, from $62.7 million a year earlier.

Sales rose 3.9 per cent to $443 million.

An announcement just made to the NZX says:

"Sky Network Television Limited today received the following communication from its major shareholder, News Limited:

"News Corporation announced that its News Limited subsidiary will divest its 44pc stake in Sky Network Television Limited, New Zealand's pre-eminent pay television broadcasting service."

Broad range

News Limited has appointed Deutsche Bank to underwrite and, together with Craigs Investment Partners, to manage, the sales of its Sky shares. It is expected that the shares will be sold to a broad range of institutional and retail investors.

Following the sales, News Limited will no longer have any holding in Sky Network Television Limited.

Chase Carey, president and chief operating officer, News Corporation said: "Sky is a world class subscription television business and has been an outstanding investment for News Corporation.

We and Sky have always enjoyed an excellent, arms-length working relationship and we expect this to continue unaffected by the sale. In particular, we do not anticipate any change to current arrangements regarding access to content and collaboration on technology."

Michael Miller, regional director of News Limited, will resign from the board of Sky and the company's shares are expected to start trading again no later than Wednesday 6 March.

Total subscribers to Sky TV's services were little changed at 846,988 at December 31 from a year earlier, though the number on MySky climbed 28 per cent to 423,973. Average revenue per subscriber rose to $75.78 at December 31 from $71.81 a year earlier.

Murdoch's investment in a German pay TV channel late last year fuelled speculation he might sell out of Sky here.

Sky was formed in 1990 by a group led by Craig Heatley with three UHF channels in the upper North Island and struggled in its early years.

The on market selldown of Sky TV also follows media group Fairfax's $769 million selldown of Trade Me in December.

This latest selldown will further add to the depth of the local market and gives the NZX another boost as it prepares for the partial float of Mighty River Power.

Murdoch's News Corp is a global media giant which owns 20th Century Fox, the Fox News cable channel as well as newspapers like the Wall Street Journal. It is the parent company for Australian publishing group News Ltd - which owns The Australian and Sydney's Telegraph - and British-based News International, publisher of the Sun and the Times.

This work is licensed under a Creative Commons Attribution-NonCommercial 3.0 New Zealand Licence.