ANALYSIS: There are many battles going on over the Fiji National Provident Fund pensions.

From The Fiji Times of July 15, it seems that the FNPF board and management are pushing ahead with their plans to reduce the pension rates of current high income pensioners (Battle 1 by current FNPF pensioners through Burness/Shameem Law) and future pensioners (Battle 2 by FICTU and so on).

Totally ignoring the sanctity of the legal contracts FNPF itself offered the retirees, they continue to focus on alleged unsustainable cross-subsidisation of current pensioners by current contributors.

They refuse to call on government statutory guarantees to finance any future shortfalls in revenue for FNPF pensions.

They also conveniently ignore that FNPF has been giving large subsidies (amounting to hundreds of millions over the last forty years) to successive Fiji governments through easily available loans, at interest rates much lower than that charged by commercial banks.

These huge subsidies by FNPF to successive Fiji governments represent a powerful moral justification for the Fiji government to fulfill their legal responsibilities to current pensioners, whatever is their pension rate.

Equally important for both Battle 1 and Battle 2, these interest rate subsidies to government must now be ended by the FNPF board and management.

For that to occur, both pensioners and current contributors need to fight Battle 3, which is to have an FNPF board completely accountable to its members.

Finally, for real long term sustainability of FNPF pensions, all need to fight Battle 4, which is to have an elected and accountable government which respects the sanctity of all legal contracts, and constitutional law and order if there is to a restoration of investor confidence and economic growth, which is the ultimate guarantee for FNPF sustainability.

But Battle 4 requires a “Road to Damascus” enlightenment for many coup supporters, including some current litigants against FNPF, to recognize that all these battles are inherently linked: justice for one group requires justice for all.

FNPF battles linked to subsidy

There are several battles going on, over the FNPF crisis, seemingly separate but inherently linked.

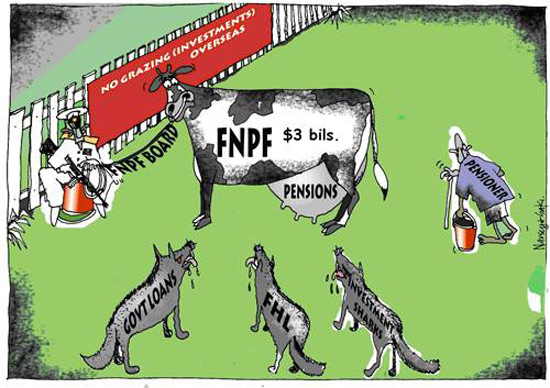

FNPF members should note that every Fiji government has wanted to borrow for their budgets (for capital or recurrent expenditure, or to pay for their scams), whenever they wanted to, whatever funds were available at FNPF, and at interest rates significantly lower than that charged by the commercial banks, locally and abroad. No commercial bank can ever match this cash cow.

Every government has therefore maintained total control over the FNPF board (the main borrower controlling the bank), which could not be allowed to be accountable to the FNPF members.

Fiji governments have also used the Reserve Bank of Fiji to force FNPF to bring back its interest earning overseas investments, which FNPF is then forced to lend to the Fiji government at low interest rates, or leave the funds idle, earning no interest.

The difference between the average weighted interest rates charged by FNPF to government, and the average weighted commercial bank lending rates has usually been more than 1 percentage point, and often more than 2 percentage points.

Ask the FNPF board and management for this information (but don’t hold your breath waiting for an answer).

With more than 2 billions lent to government, the subsidy from FNPF to government annually amounts to more than $20 millions for every 1 percent difference in the interest rates between FNPF and the commercial banks.

Roughly, over the last 40 years, this subsidy from FNPF to government may have amounted to as much as $800 million in today’s currency (give or take a few millions).

Government therefore not only has a legal obligation under the FNPF Act to cover any shortfalls for payment to existing pensioners, but it also has a moral obligation because it has enjoyed these massive subsidies in the past, and continues to enjoy now.

Common solution to Battles 1 and 2

If the FNPF board were to end the ongoing subsidy to the Fiji government and charge the same interest rates as charged by the commercial banks, this will immediately improve the revenues for FNPF, and enable the FNPF to

1. maintain the payments to current pensioners and

2. enable the FNPF to continue to pay the current 15 percent (or somewhere near it) to future pensioners, not the paltry 9 percent they are offering by military decree.

3. end the huge distortion of Fiji’s financial markets, and also removing the incentive for Fiij’s fiscal irresponsibility.

It is the fiduciary and ethical duty of the FNPF board and management to increase the interest rates charged for loans to government, towards the commercial banks rates.

Will the FNPF board and management do so? Not a hope (as the correspondence between the chairman of the FNPF board and the CEO of Credit Corp clearly shows.

Indeed, the FNPF board and management, despite their clear fiduciary duty of “full disclosure” where FNPF members’ interests are adversely affected by any board decision, continue their shameless refusal to disclose all the relevant reports to the FNPF Members.

The fact that these FNPF board members won’t resign either, speaks volumes for their lack of ethics and moral fiber or “balls” as Ross McDonald suggested to the chairman of FNPF board.

The personal interests of the management and board members (and for some, the interests of their companies or employers) too obviously depend on pleasing the military regime.

Will the legal case succeed?

The legal case by some pensioners may be given favorable hearing by the judiciary for two interesting reasons.

First, there are many prominent persons in the military regime’s hierarchy (it is a long list - you can draw it up) who personally stand to lose a lot, if the existing pension rates are reduced.

Second, allowing the pensioners’ case to succeed, could be good propaganda for the military regime, to show the world it respects “law and the judiciary”.

But the planned pension rate reduction for future pensioners is still likely to go ahead, simply because this military regime desperately needs the cheap cash to keep financing their irresponsible deficits.

And of course, the FNPF board and management (i.e. the military regime) may go ahead with the illegal reduction of the current high pensions.

FNPF pensioners may protest that this is a denial of natural justice.

But this military regime has denied its citizens natural justice on a whole raft of cases, from the day it did the military coup in 2006. So what’s new?

How ironic that some FNPF pensioners are now appealing to an illegal President to have a Commission of Inquiry into the FNPF, when none of them ever asked for an inquiry into the coups of 1987, 2000 and 2006, which have done far more damage to the ordinary people of this country.

Common Battle 3

The interests of both current pensioners and current contributors could be better served if they, as the legitimate owners, could control the FNPF board.

Will it happen? Not under this current military regime.

Common Battle 4

It is abundantly clear that FNPF’s financial problems would have been much smaller, had the Fiji economy been growing solidly, with solid growth of employment and new contributors to the FNPF, and solid growth of incomes and dollar values of all contributions.

This requires the restoration of investor confidence that has been shattered by the military coup of 2006 and military decrees stopping litigants from taking their grievances to court.

How ironic that the lawyers and leading pensioners now appealing to the “rule of law” to protect their pensions, themselves supported the 2006 coup which broke the fundamental laws of the land.

One former High Court judge who is vociferously calling for good corporate governance, conveniently ignores the biggest corporate malpractice in front of her: the FNPF board and management shamelessly ignoring the wishes of the owners of the FNPF while obeying the illegal military regime she helped establish.

One lawyer who is currently fighting the case challenging the legality of the FNPF’s planned slashing of pension rates by appealing to the sanctity of contracts, was the Human Rights Commissioner who passionately justified the 2006 military coup, despite all its hollowness, illegalities, breaking of contracts, and military decrees denying basic human rights and natural justice to thousands of Fiji citizens.

There are also many prominent pensioners, currently challenging the legality of FNPF’s actions, who supported the Bainimarama coup and the NCBBF’s Charter Charade (with its first article proclaiming the supremacy of the 1997 Constitution).

All these legal cases against FNPF would not have been necessary if these “good” people had not instigated and justified the 2006 military coup in the first place.

FNPF’s other links

Those fighting to protect their interests in the FNPF need to also understand the linkages to major economic disasters and decisions which have led to excessive government borrowing from FNPF:

1. the need to cover the National Bank of Fiji disaster (catalysed by the 1987 coup) and the SVT government’s creation of the disastrous ATH monopolies, with an excessive price paid by FNPF.

2. the numerous vote buying scams by successive governments resulting in wasteful government expenditure;

3. the massive budget blow-outs by the military following the 2000 and 2006 coups;

4. the massive investment losses caused by FNPF board decisions, all kept secret by the Military Regime, the media censorship and the Public Emergency Decree.

5. the utter waste of large loans by Military Regime appointees, such as at the FSC, while callously rejecting a $300 million EU subsidy for the sugar industry.

6. the senseless borrowing of $500 millions internationally at 9 percent interest when IMF was willing to lend at 2 percent.

There are other misallocations we still do not know about because of the military regime’s refusal to release the Auditor General’s Reports.

These are all linked to the FNPF malaise.

If those who are currently litigating against the FNPF, only fight their own narrow battle while turning a blind eye to the other injustices around them, there is little hope for the hundreds of thousands of poor Fiji people, for whom no lawyers are going to bat (for fee, or for free - if that might help save tarnished reputations).

Is FNPF the Road to Damascus?

Reading the above, it is natural for us to feel bitter and get into the “blame game” over FNPF, but that is not going to help FNPF, or fund members, and the future generations.

Note that the current FNPF crisis is probably the first clear national issue which brings together all of Fiji’s ethnic groups, religious groups, divisions, political parties, genders, age groups, and even the members of the police and military forces.

But our people need to understand that all these battles over FNPF are inherently linked to national ideals of good governance and accountability.

There cannot be legal justice for just one group, and not for others.

Now that every significant political and social group in Fiji have bent or broken the supreme laws of the land (in 1987, 2000 and 2006), we are long overdue for a national “Truth and Reconciliation” process.

That requires all our leaders to have the humility and courage to admit error (as some “movers and shakers” seem to be doing, I hear), and genuinely ask for forgiveness from each other.

FNPF may well provide these erring individuals the opportunity to have their “road to Damascus” enlightenment.

Not taking such an opportunity will mean that our leaders will collectively drive another nail into the national coffin, and it is a long time since Lazarus was raised from the dead.

These are the personal views of Professor Wadan Narsey, not those of University of the South Pacific where he is employed as professor of economics. He is currently on leave in Japan.