Can Fiji National Provident Fund contributors and pensioners assist it become more viable?

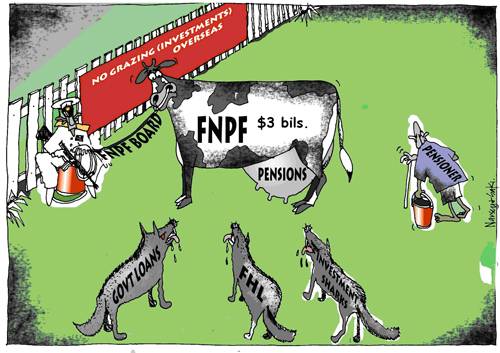

With a stagnating economy, FNPF revenues have been severely constrained. Few new jobs have been created and existing incomes have not grown; many loans are non-performing; returns on FNPF investments have been declining; and large amounts of capital values have been written off because of mismanagement.

But collectively, FNPF contributors and pensioners remain the largest group of spenders in the Fiji economy.

Here is the challenge: can FNPF contributors and pensioners direct their consumption expenditure towards FNPF investments, and change FNPF policies for the better? Can FNPF management encourage this by providing financial incentives and changing their management structure?

Can FNPF management encourage this by providing financial incentives and changing their management structure?

Can all FNPF stakeholders (FNPF itself, unions, pensioners, civil servants etc) conduct marketing campaigns in aid of FNPF assets and loans?

If such campaigns work, others may lose: but given the current pressures on FNPF, FNPF contributors and pensioners must look after our own life savings first.

FNPF investments and loans

What are the FNPF investments and loans? By far the largest disposition of FNPF funds is in the form of loans to the Fiji government.

Then there are other investments and large loans:

* the giant Amalgamated Telecom Holdings Ltd (ATH),

*the Intercontinental Hotel and Golf Course at Natadola,

* Fiji Sugar Corporation, *

Home Finance, * Holiday Inn,

* the Grand Pacific Hotel (currently used by backpacking soldiers),

* Penina Ltd (Tappoos City), and

* numerous others on which there is little information in FNPF’s 2010 Annual Report.

How can FNPF contributors and pensioners encourage these loans and investments “come good” for FNPF?

The easy nuts to crack

To which FNPF investments and loans can FNPF contributors and pensioners direct their spending, so as to improve returns to FNPF? Some are quite easy to see.

Home loans may be taken from Home Finance Corporation (HFC), rather than giving the business to other financial institutions, many of which are foreign-owned enterprises which export their profits.

Holiday Inn facilities could be used wherever possible, for conferences, food, and leisure activities.

The accommodation, conference, golfing facilities at the Intercontinental (Natadola) could be used wherever possible rather than the alternatives which are often used. (Can we renegotiate a restoration of Vijay Singh’s endorsement of the Golf Course?)

FNPF consumers could, wherever possible, use the Tappoo City retail outlets to which more than $40 million of FNPF funds have been lent.

Workers at FSC (lent more than $50 million of FNPF funds) must do all they can to ensure that the mills work efficiently, producing maximum sugar output, with minimum break-downs.

Those large unions with entrepreneurial abilities (FTUC, FPSA, FTU, FTA) can assist FNPF investments in GPH and Momi “come good” instead of the disasters they seem destined to be under this military government.

What can FNPF management do?

If FNPF gets around to issuing ID cards to FNPF contributors and pensioners, then FNPF investments or receivers of FNPF loans could be encouraged to give discounts to FNPF card-holders.

There could be special discounts on interest rates for Home Finance loans.

There could be discounts on bills at Holiday Inn. [FNPF management could get some commercial advice on how to make Holiday Inn become the gold mine that it should be, taking advantage of the glorious location, overlooking the harbor and the mountains, with more attractive prices for drinks and food].

There could be serious discounts on accommodation, food, and golf fees at the Intercontinental Natadola to ensure that it operates close to 100% capacity, by attracting more business from Suva and other population centres.

Tappoo City outlets could offer discounts on all FNPF card holders but the City Council can also help. Look out the top floor windows of the Tappoo City building, and admire the mountains, the beautiful bay, and then right below your eyes, is the garbage on the roof of the Nabukulou Fish market, and the Garrick Hotel roof, reducing the value of FNPF’s multi-million dollar investment in Tappoo City.

What are all the other Fiji investments where FNPF revenues may be directly or indirectly encouraged?

The tough nuts to crack

Loans to government will be repaid to FNPF more easily if there is healthy economic growth, allowing government tax revenues to grow healthily.

For this to happen, each and every FNPF contributors and pensioner needs to seriously consider all the political and legal factors that are constraining investment by foreigners and locals.

We all need to try and restore a credible and widely acceptable government which operates without the divisiveness that has existed in previous years.

The less said the better, about making ATH more profitable- we FNPF contributors are between the Devil and Deep Blue Sea here.

How to organise FNPF contributors and pensioners?

To make any difference, FNPF contributors need to be organised over this issue. That should not be difficult as the bulk of FNPF contributors are wages and salaried persons.

Public and private sector unions must mount campaigns with their members, making them aware where their FNPF investments are, and where they should direct their spending.

Large groups of contributors who don’t have unions, such as Fiji Military Forces and the Fiji Police Force must discuss and organise themselves.

Wherever possible, government-funded or sponsored conferences organised by regional and international multilateral bodies and donors (SPC, Forum, SOPAC, ADB, AusAID, WHO, UNDP, NZ Aid, etc) should be held at FNPF investments- such as at the Intercontinental or the Holiday Inn.

But ultimately, it all boils down to who sits on the FNPF board.

Representation on FNPF board

It has long been recognised that the FNPF board must be completely independent of the Fiji government and the Reserve Bank of Fiji, which may have some representation, of course, but not over-riding control, as at the moment.

There must be democratic elections to the FNPF board, by FNPF contributors and pensioners separately, of a reasonably large number of representatives.

To ensure that solid professional persons are elected, strict criteria may be set, for who may stand for elections to the board.

The chair must be drawn from these elected representatives.

The FNPF board must ensure that responsible representatives are nominated on the committees to guide the GPH and Momi projects, with some co-funding from unions to ensure commitment.

Such representatives do not have to be FNPF board members. Why indeed do some at the moment continue to hold multiple board membership, often with conflicts of interest?

Note current study

FNPF has recently commissioned an independent Australian team to advise how the FNPF Act and management structure should be reformed.

This study team will no doubt want to recommend that the FNPF board becomes more if not fully independent of the Fiji government and the Reserve Bank of Fiji.

Let us hope, for the sake of the FNPF contributors and pensioners, that this independent study is allowed to make its recommendations freely.

FNPF members should also ask why there is so little information on all of FNPF’s investments in the 2010 FNPF Annual Report?

Why does the FNPF management refuse to make public the ILO, World Bank and other recent reports on the financial sustainability of the FNPF?

Where indeed is the “accountability” and “integrity” that is boldly stated in the FNPF vision?

Despite the reassuring noises coming from the unaccountable FNPF executives and board, FNPF members have a long way to go before they can breath any sigh of relief over their life savings, investments and pensions.

If they do not discuss these issues and organize to protect their life savings they will end up weeping buckets of tears.

And please, don’t blame the Bainimarama regime’s senseless media censorship for your continued silence and inaction. The internet is here to stay.

Author's note: Why would the Bainimarama regime ban this article from a daily newspaper? What greater damage is being done to our people’s welfare which the papers are stopped from reporting, every day? Why do we Fiji citizens continue to suffer this daily loss of our basic human right to freedom of expression, without even a whimper?

A 2009 article on the FNPF by Professor Narsey